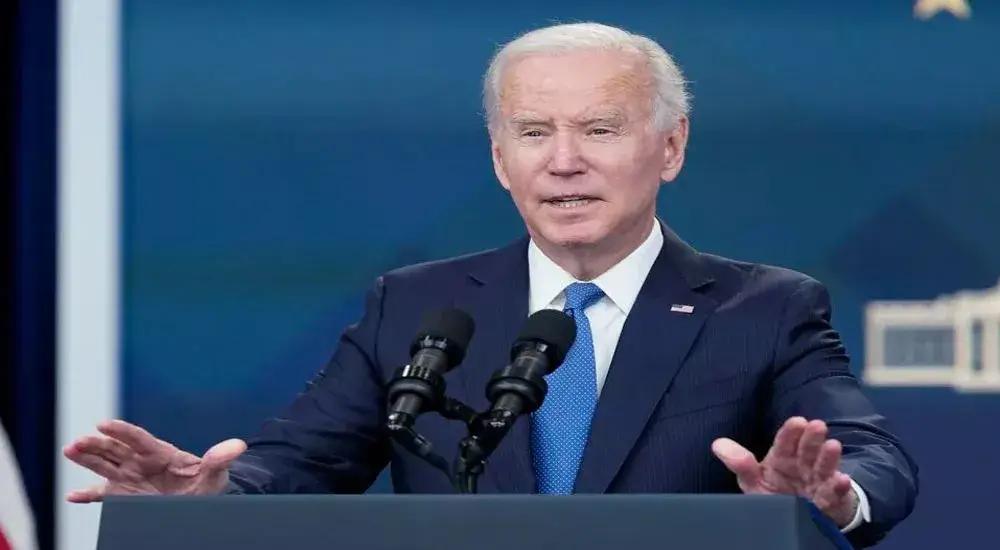

The White House revised its fiscal 2023 U.S. budget deficit forecast to $1.543 trillion, a $26 billion decrease from the March projection. This revision is mainly due to a major reduction in outlays after the Supreme Court struck down President Joe Biden’s student loan forgiveness program in June.

The Office of Management and Budget (OMB) stated that the student loan decision would reduce fiscal 2023 outlays by $259 billion, partly offsetting the $430 billion charge taken by the Biden administration in fiscal 2022 to cover the program’s costs.

In response to the blocked student loan forgiveness program, Biden announced changes to an income-driven student loan repayment program, aimed at reducing low-income workers’ annual payments by around $1,000 and ending their repayments sooner. These changes and other adjustments would lead to $74 billion in added costs in 2023, reducing the overall savings from the court’s decision. Additionally, OMB projected $85 billion in additional outlays through 2033 due to the same changes.

The OMB’s Mid-Session Review update estimated a net reduction in 2023 outlays of $242 billion, considering the student loan savings, as well as lower unemployment compensation and increased costs for Social Security, Medicare, and clean energy tax credits.

Estimates for tax credits associated with Biden’s Inflation Reduction Act, including those for electric vehicle purchases and investments in battery production, were $4 billion higher for 2023 and $120 billion higher over a decade than previously forecast.

The reduction in 2023 outlays was partly offset by a $215 billion net reduction in receipts, primarily due to lower collections to date and technical revisions based on new tax reporting data, according to the budget office.

Economic forecast changes had a minimal impact on the budget revisions, with a $4 billion increase in 2023 receipts compared to the March forecasts. The OMB maintained its forecast for 2023 U.S. real GDP growth at 0.4%, while lowering its 2024 growth forecast to 1.8% from 2.1% based on data as of June 1.

Regarding unemployment, OMB forecasted lower rates for 2023 at 3.8% compared to 4.3% in March, and 4.4% for 2024, down from 4.6% in March.

Over the 10-year budget window, OMB estimated that if Biden’s fiscal 2024 budget proposals were enacted, including substantial tax increases on the wealthy and corporations, cumulative deficits would be $107 billion higher than estimated in March. Nevertheless, the 10-year deficits would still be roughly $2.6 trillion lower than OMB’s current-law baseline.